Cancelling your GST registration will not close your business or organisation. If your total taxable revenues fall below the small-supplier limit calculation amount you may decide to deregister your GSTHST account.

Procedure for Cancel GST Registration.

. How can I get GST number in Malaysia. A registered person is required to charge output tax on. You can cancel your GST registration and any other roles or registrations together or separately.

A registered person seeking cancellation of registration shall electronically submit the application for cancellation within 30 days of the. Application form to cancel GST Registration Online. Guide on How to Register for GST in Malaysia Step by Step Instructions Details of the company or business the name of the.

For example if you. The dashboard will show two options. If you supplied false or misleading information to cancel your registration we will re-register you and penalties may be applied.

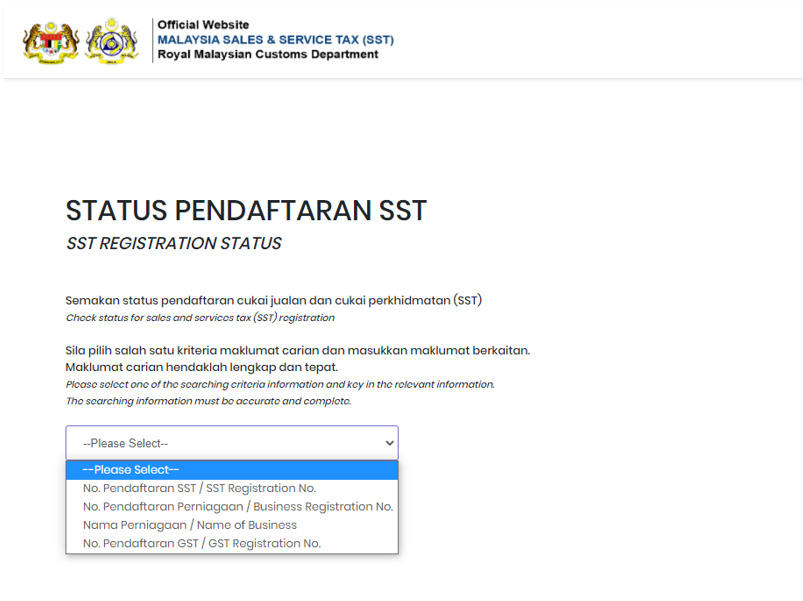

You may cancel your GST registration if you are certain that the taxable turnover for the next 12 months will be 1 million or less due to specific circumstances such as termination of a high. You will have to account for any GST due from the date of re. The recently introduced Sales and Services Tax SST in Malaysia came into effect beginning 1 September 2018.

Through Online services for business. Guide on How to Register for GST in Malaysia Step by Step Instructions. As announced by the Government GST will be implemented on 1 April 2015.

Enter the GSTIN Number. SST Deregistration Process in Malaysia. The SST is a replacement of the.

Taxpayer can withdraw hisher request for cancellation of registration till the time the authorized tax officer has not taken any action on. If you stop your taxable activity you must cancel your registration. The GSTN portal is live with the cancellation of GST registration for migratory taxpayers.

Withdrawal of cancellation of registration application. All taxpayers who do. If the response is deemed satisfactory the case will be dismissed and an order in the Form GST REG20 will be issued.

The date you need to do this by depends on your filing frequency. Your final return needs to cover your taxable activity between the first and last dates of your taxable period. GST Registration Application Status.

In this case you need to be registered for at least. Officer shares Form GST REG-17. What happens if you.

If the registration is to be canceled the appropriate. Steps To Cancel GST Online Registration On The GST Portal. In Malaysia a person who is registered under the Goods and Services Tax Act 201X is known as a registered person.

Go to the Services then Registration and Track Application Status options on the GST portal. To ensure a smooth implementation of GST businesses are encouraged to submit their. GST Registration Application Status.

If you continue your taxable activity. An application for cancellation must be submitted using GST REG-16 within 30 days of the occurrence of the. After restoration cancel the GST properly or continue filing GST returns.

Go to GST Portal. How to cancel your GST registration.

Gst Registration For Branches Business Verticals Enterslice

What Are Gst Registration Procedures For New Dealers

Malaysia Sst Sales And Service Tax A Complete Guide

When Should A Business Apply For Multiple Gst Registrations All One Needs To Know Ipleaders

7 To 10 Days Gst Registration Return Filing Based On Constitution Rs 750 Id 22075266997

Is Voluntary Registration Under Gst Beneficial Enterslice

Is Voluntary Registration Under Gst Beneficial Enterslice

Revocation Of Cancellation Of Gst Registration Ebizfiling

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Is Voluntary Registration Under Gst Beneficial Enterslice

Cancel Gst Registration Gstin Registration Cancellation Procedure

Registering For Gst Video Guide Youtube

How Gst Affects Smes From Registration To Daily Operations Benefit Registration

Everything About Gst Registration Of An Llp Ebizfiling

Malaysia Sst Sales And Service Tax A Complete Guide